Contents in this Page

Aims of organization

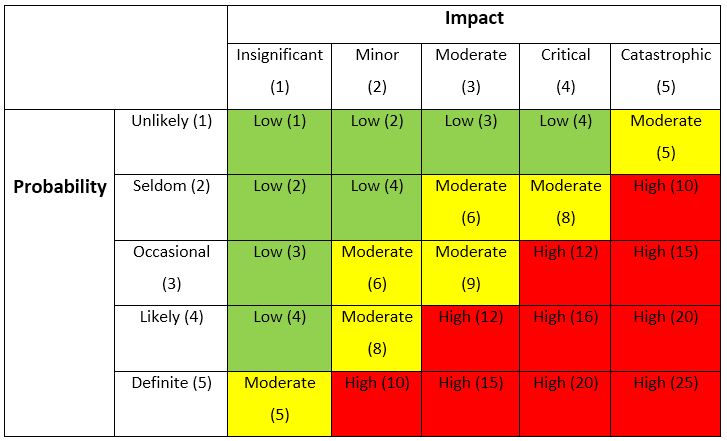

Risk Management at British Airways will be analysed in this report in detail. The selected company for this report is a UK-based airline company with a global footprint. The vision of the company is to be the world’s leading global premium airline (British Airways Plc., 2018). To achieve the long-term vision, it has some aims, which are analyzed below:

British Airways aims to be the premium airline choice of customers by introducing business class seats, cabins and onboard state-of-the-art facilities (British Airways Plc., 2018). To outstand from the competitors, it also wants to develop premium facilities in airports of the world’s key cities. British Airways also wants to be the best in providing outstanding services at every touch point through world-class hospitality and customer service. Thirdly, British Airways aims to grow its active presence in major cities of the world as part of its plan to ensure that its customers can have flights in every major city of the world (British Airways Plc., 2018). Finally, British Airways aims to introduce new revenue streams by introducing on-board sales, car rental packages with flights, third-party engineering etc. (British Airways Plc., 2018).

You may also feel interested to read the blogs:

External Environment Analysis of Marriott International

PESTEL, SWOT and Porter’s Five Forces Model of MC Donald’s

Business Model Canvas and Corporate Structure of MC Donald’s

Macro Analysis of MC Donald’s

However, all of these are only aims which might be affected because of a number of risks that may bring opportunities for losses. This report will critically analyze the risk factors that British Airways may face.

Risk Threshold

Risks are events that have the possibility to occur in organizations. Risks can bring both positive impact and negative impacts. A company tries to reduce the extent of a negative impact and wants to be prepared to utilize the positive possibilities (Lam, 2014). British Airways is also prone to a number of internal and external risks, some of the risks may bring a positive impact, but some other may result in a negative impact on the organization.

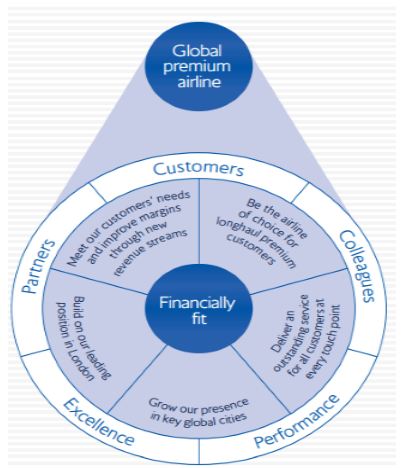

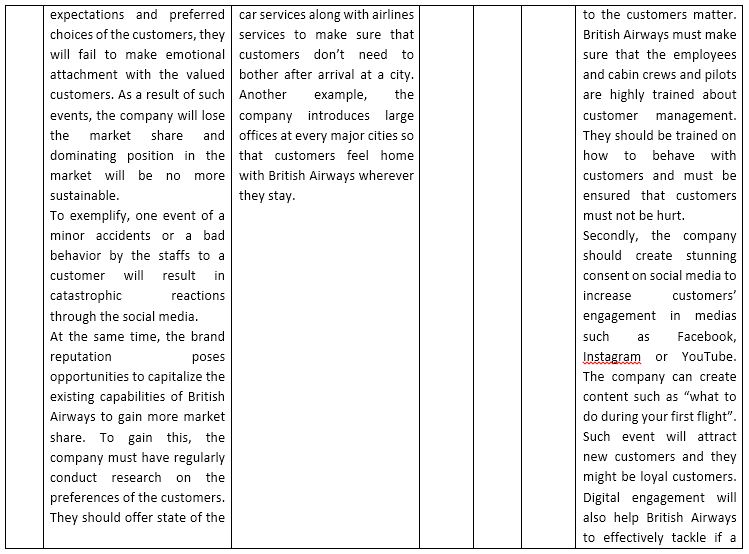

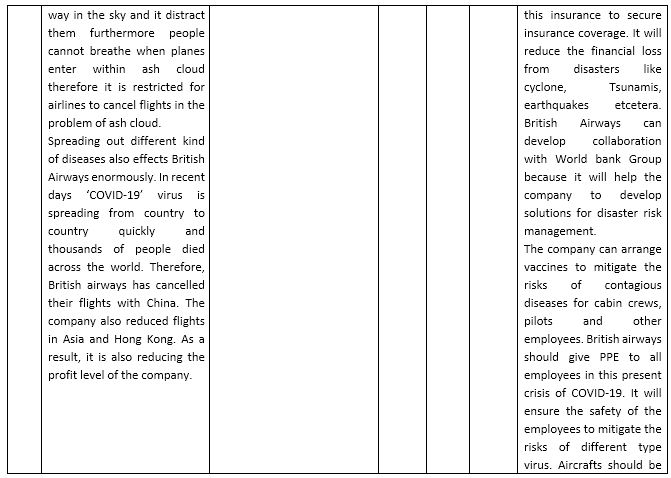

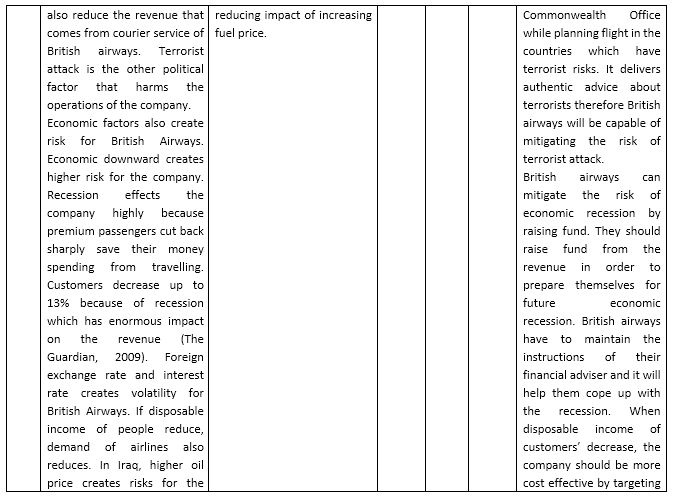

The below matrix is called Impact Probability Matrix, which includes impact on the vertical axes and Probability on the horizontal axes (Olson, and Wu, 2015). Here, the impact implies the severity of influence that risk event may have on certain activities of British Airways or any other company. The extent of the impact may vary from “insignificant impact on British Airways” to “catastrophic impact on British Airways”.

On the other hand, probability refers to the likelihood or chances that certain risks may take place (Chapman, 2011). The extent of probability may vary from “unlikely to happen” to “certainly will happen”. The above Matrix shows different scenarios of risk index with the multiplications of impact factors and probability factors.

An important concept in the above matrix is the Risk Threshold which means a ceiling point above which all risks must be addressed and below which all risks are acceptable (Hoyt and Liebenberg, 2011).

On the above matrix, all green squares with a maximum mark of 4 stand for low-risk index. It means that the company doesn’t need to pay extensive care for such risk events because the severity of impact and probability is much less than the risk threshold. On the other hand, yellow squares with maximum marks from 5 to 9 represent a moderate risk because there is some likelihood that the risk will occur and will have a moderate impact on the organization. British Airways should pay attention to such risks scoring in yellow squares. Finally, the red squares with 2 digits are highly risky and require extensive addressing by British Airways.

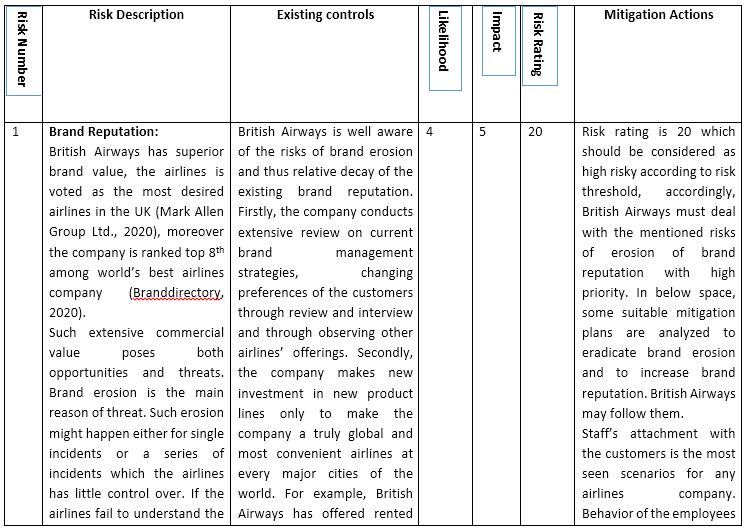

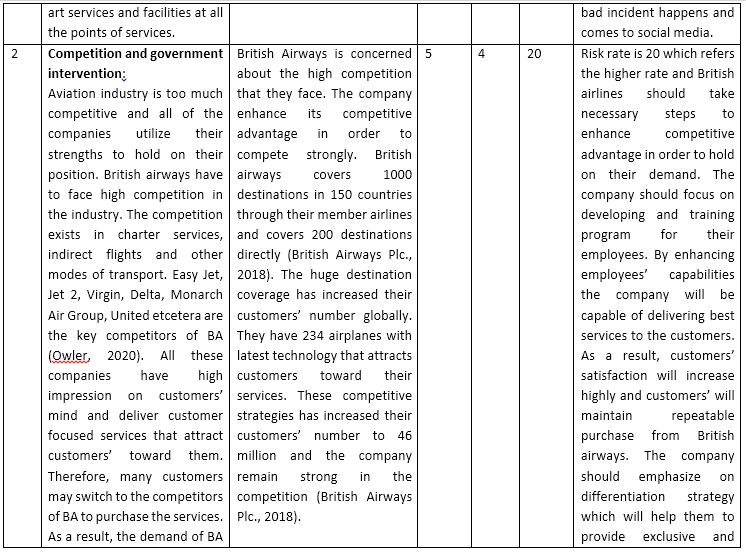

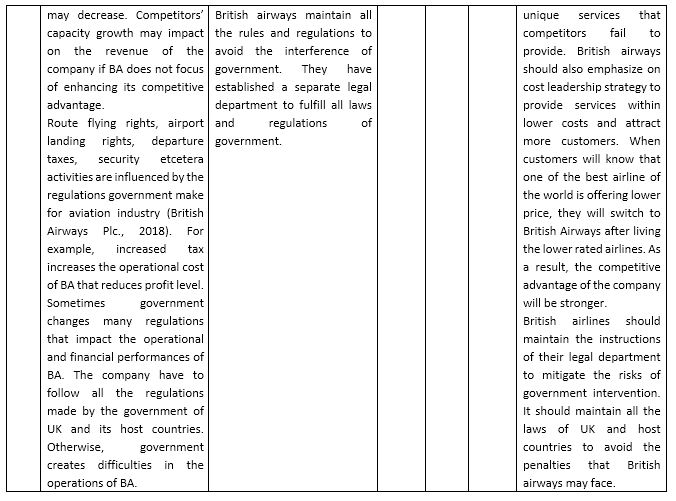

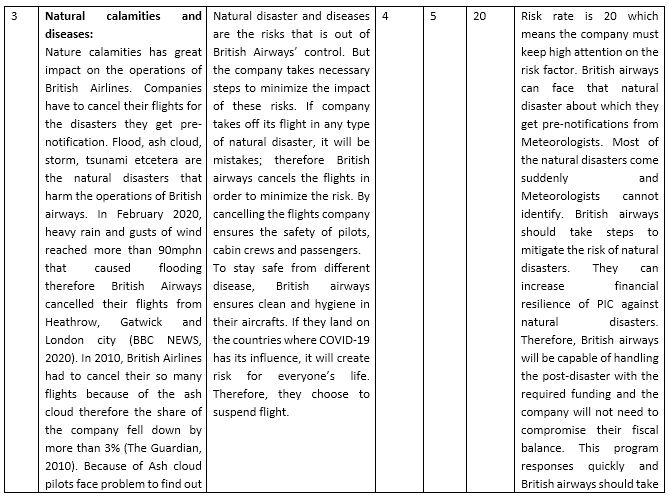

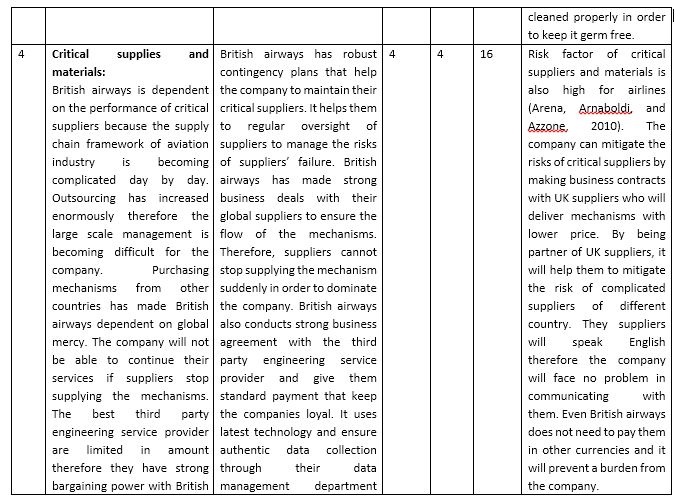

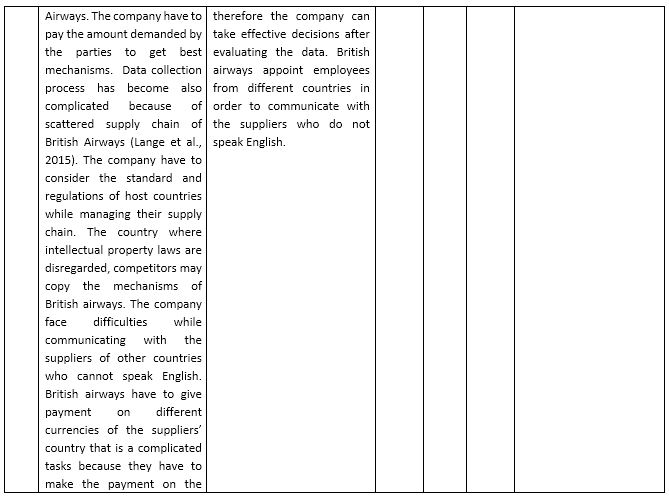

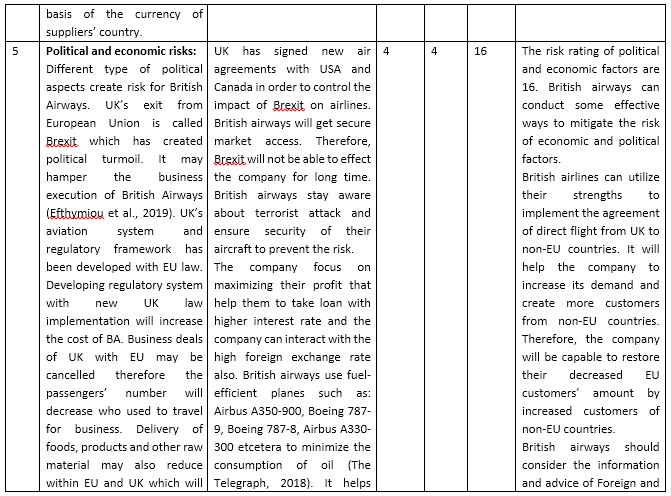

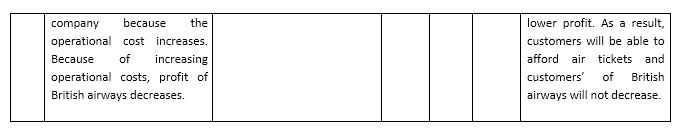

Risk Register

Conclusion:

BA has a target of being one of the most demandable airlines across the world. To achieve the vision, the company has some aims, such as expanding superior quality services in the key cities of the world and ensuring state-of-the-art facilities during the flights and at every touch point. To main its leading position and generate more revenue, the company have to take the required steps to mitigate all the risk factors. BA conducts an extensive review to manage its brand reputation, but they have to deliver more customer-based services to hold on to its customers and create new customers. Competition in the aviation industry is high, and the company has developed diverse destinations and developed the most advanced aircraft to compete strongly. BA can enhance its competitive advantage by ensuring the best services. Government interference creates complexities in their operations. Therefore, BA should maintain all the regulations to avoid the risk of government interference in operations. It faces the risk of critical suppliers and materials. To face this risk, BA has developed a robust contingency plan to handle these risks, but they can mitigate the risks more by finding out lower-cost suppliers within the UK.

References:

Arena, M., Arnaboldi, M. and Azzone, G., 2010. The organizational dynamics of enterprise risk management. Accounting, Organizations and Society.

British Airways Plc., 2018. Annual Report and Accounts. Year ended 31 December 2018. Retrieved from: https://www.iairgroup.com/~/media/Files/I/IAG/annual-reports/ba/en/british-airways-plc-annual-report-and-accounts-2018.pdf [Assessed on 19 March 2020]

Branddirectory, 2020. AIRLINES 50 2019 RANKING. Retrieved from: https://brandirectory.com/rankings/airlines/table [Assessed on 17 March 2020]

BBC NEWS, 2020. Storm Ciara: Floods and travel disruption as UK hit by severe gales. Retrieved from: https://www.bbc.com/news/uk-51425482. [Assessed on 21 March 2020]

The Guardian, 2009. UK air passenger numbers slump as recession bites. Retrieved from: https://www.theguardian.com/business/2009/jun/16/uk-air-passenger-numbers-decrease-recession. [Assessed on 23 March 2020]

The Telegraph, 2018. British Airways is the least fuel-efficient transatlantic airline – and Norwegian the most. Retrieved from: https://www.telegraph.co.uk/travel/news/fuel-efficient-transatlantic-airlines-norwegian-ba/. [Assessed on 24 March 2020]